|

Just Released

|

||

|

Poll: Survey of the Non-Group Market Finds Most Say the Individual

Mandate Was Not a Major Reason They Got Coverage in 2018, And Most Plan

to Continue Buying Insurance Despite Recent Repeal of the Mandate

Penalty

A

Majority of ACA Marketplace Enrollees Perceive the Marketplaces As

“Collapsing,” But Most Say They Are Not Paying More for Coverage Compared to

Last Year

Very

Few Say They Would Want to Purchase a Short-Term Plan, A Regulation Being

Drafted By The Trump Administration

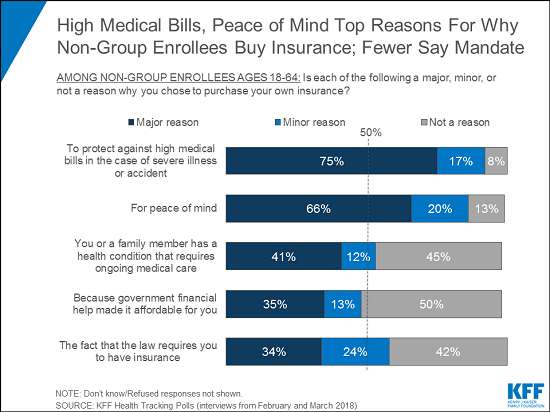

Nine in 10 enrollees in the non-group market say

they intend to continue buying their own insurance even after being told that

Congress has repealed the individual mandate penalty for not having coverage

as of 2019, according to a new survey by the Kaiser Family Foundation. The

survey finds the mandate, part of the Affordable Care Act, ranks low among

the reasons people give for buying their own insurance in 2018.

The survey also finds a lack of awareness about

the status of the mandate penalty, with 1 in 5 non-group enrollees (19%)

saying they are aware the penalty has been repealed but is still in effect

for this year. The mandate continues to rank far down on a list of “major

reasons” people give for buying their own insurance, below reasons such as

protecting against high medical bills (75%), peace of mind (66%), or because

they or a family member has an ongoing health condition (41%).

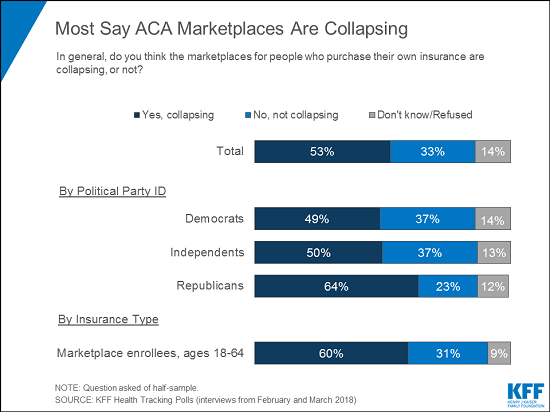

At a time when the ACA is often labeled as

“failing” by its critics in Congress and the Trump administration, the survey

also finds that about half of the public say they believe the ACA

marketplaces are “collapsing” (53%, up from 42% in January) -- including 6 in

10 who purchase insurance through the marketplaces. Across party

identification and insurance type, more say the marketplaces are collapsing

than say the marketplaces are not collapsing. Recent figures show that insurers in the marketplaces

are now turning a profit, but repeal of the individual mandate penalty and

other policy changes put forth by the Trump administration would create

greater volatility next year.

In addition, the poll finds at least half of

non-group enrollees in general and marketplace enrollees specifically are

worried about the future of health insurance availability and costs in their

areas. Fifty-one percent of all non-group enrollees and 58 percent of

marketplace enrollees say they are “very worried” or “somewhat worried” there

will be no insurance companies left selling plans in their area in the

future, and similar shares worry that their current insurance company will

stop selling plans in their area (49% and 58%, respectively).

Despite

Overall Pessimism About The Future of the ACA Marketplaces Generally, Most

Say Their Premiums Have Not Increased and Are Satisfied with Available

Options

When asked about their own experience, however,

most marketplace enrollees say their premiums have not gone up in 2018.

One-third (34%) say their premiums are “about the same” as last year and a

fourth (23%) say their premiums went down, while four in ten (42%) say their

premiums have increased. These breakdowns are similar to the share of the

overall non-group market who say their premiums have increased (46%), stayed

the same (35%), or decreased (18%).

In the marketplaces, this is likely attributable

to the federal tax credits most enrollees receive to help cover premium costs

and protect against steep increases. It also may reflect a “silver loading”

strategy in which many states, concerned about the possibility of large

premium hikes due to the loss of federal cost-sharing reduction payments,

concentrated insurers’ premium increases on the silver benchmark plans that

help determine the level of federal financial assistance available to

enrollees.

The majority of marketplace enrollees (60%) say

their deductibles are about the same as last year. Three in ten saw an

increase in their deductibles and few (8%) say they experienced a decrease.

In addition, a majority of marketplace enrollees

(61%) say they were satisfied with their insurance options for 2018 and most

(68%) said they did not experience problems during the open enrollment

period.

Few

Non-Group Enrollees Say They Would Prefer Short-Term Insurance Plans

The survey also finds little appetite among

current marketplace enrollees for the non-renewable short-term insurance

plans that President Trump has recently sought to expand access to through an

executive order and newly proposed regulations. Such plans tend to cost less

than ACA plans but provide fewer benefits, and are exempt from ACA

requirements that insurers accept all applicants and cover pre-existing

conditions.

When asked whether they would want to purchase

such a plan or keep the plan they have now, the vast majority of non-group

enrollees (84%) say they would keep the plan they have now, while 12 percent

would want to purchase a short-term plan. Responses were similar among

individuals living in households both with and without pre-existing

conditions.

The new survey examines people’s experiences with

the current health insurance market focusing on individuals who have health

insurance they purchased themselves in the non-group market. It also compares

the experiences of these individuals to those people who get their insurance

through their employer as well as those who do not have health insurance

coverage.

The survey was designed and analyzed by

researchers at KFF. Telephone interviews were conducted from February 15-20

and March 8-13 among a nationally representative random sample of 2,534 adult

U.S. residents (882 via landline and 1652 via cell phone), including an

oversample of respondents who purchase their own insurance (Non-Group

Enrollees). The margin of sampling error is plus or minus 2 percentage points

for the full sample, plus or minus 7 percentage points for all non-group

enrollees, and plus or minus 9 percentage points for marketplace enrollees.

For other subgroups, the margin of sampling error may be higher.

Filling

the need for trusted information on national health issues,

the Kaiser Family Foundation is a nonprofit organization based in San

Francisco, California.

|

||

|

||

To be a Medicare Agent's source of information on topics affecting the agent and their business, and most importantly, their clientele, is the intention of this site. Sourced from various means rooted in the health insurance industry - insurance carriers, governmental agencies, and industry news agencies, this is aimed as a resource of varying viewpoints to spark critical thought and discussion. We welcome your contributions.

Tuesday, April 3, 2018

Survey of the Non-Group Market Finds Most Say the Individual Mandate Was Not a Major Reason They Got Coverage in 2018

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment