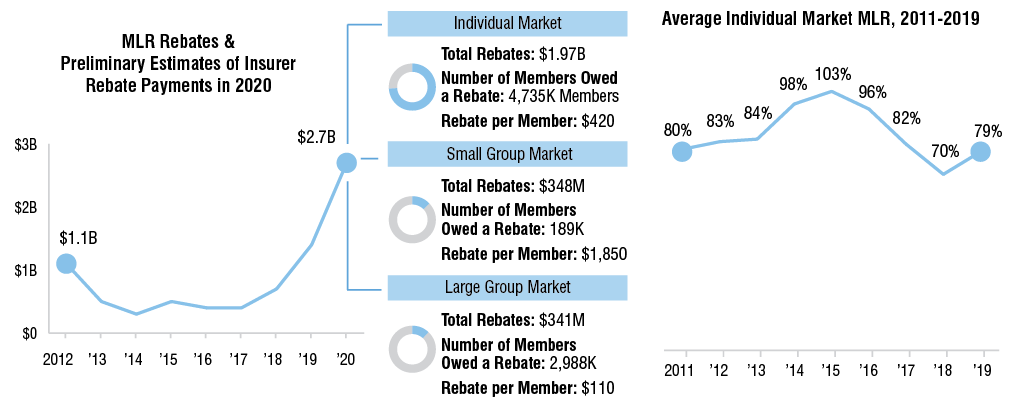

Insurers that participate in the individual, small-group and

large-group markets are projected to issue a record high $2.7 billion in

medical loss ratio (MLR) rebates to their customers this year — nearly doubling

the $1.4 billion in rebates issued last year, according to a recent Kaiser

Family Foundation analysis. Almost 75% of the rebates in 2020 will come from

individual market insurers. Looking ahead, the analysis notes that even if

individual market insurers experience losses in 2020 due to costs related to

the COVID-19 pandemic, they could still owe rebates in 2021 because MLR rebates

are calculated using the last three years of insurers' financial data.

Individual market rebates were so high in 2020 primarily because insurers had

strong financial performances in 2018 and 2019.

NOTES: The number of members is rounded to the nearest thousand,

and shows the average 2019 monthly membership in plans that owe rebates in

2020. These figures do not include health plans managed by the California

Department of Managed Health Care. Rebates being paid out in 2020 are based on

experience from 2017-2019 and will be issued to consumers enrolled in 2019.

Rebates for 2020 are based on preliminary insurer estimates, and final numbers

will be released later in 2020. The large group market only includes

fully-insured plans.

SOURCE: "2020 Medical Loss Ratio Rebates," Kaiser Family Foundation. Visit https://bit.ly/2zosGOH.

SOURCE: "2020 Medical Loss Ratio Rebates," Kaiser Family Foundation. Visit https://bit.ly/2zosGOH.

Subscribers

may read the Health Plan Weekly article in

which this infographic appeared online. Learn more about

subscribing to AIS Health's publications.

No comments:

Post a Comment