|

Crypto Assets and Blockchain: Fad, Threat, or New Normal?

An analysis by Dana M Peterson, Chief Economist, The

Conference Board & Hollis Hart, Former President, International Franchise

Management, Citi |

|

Click on the chart to enlarge |

|

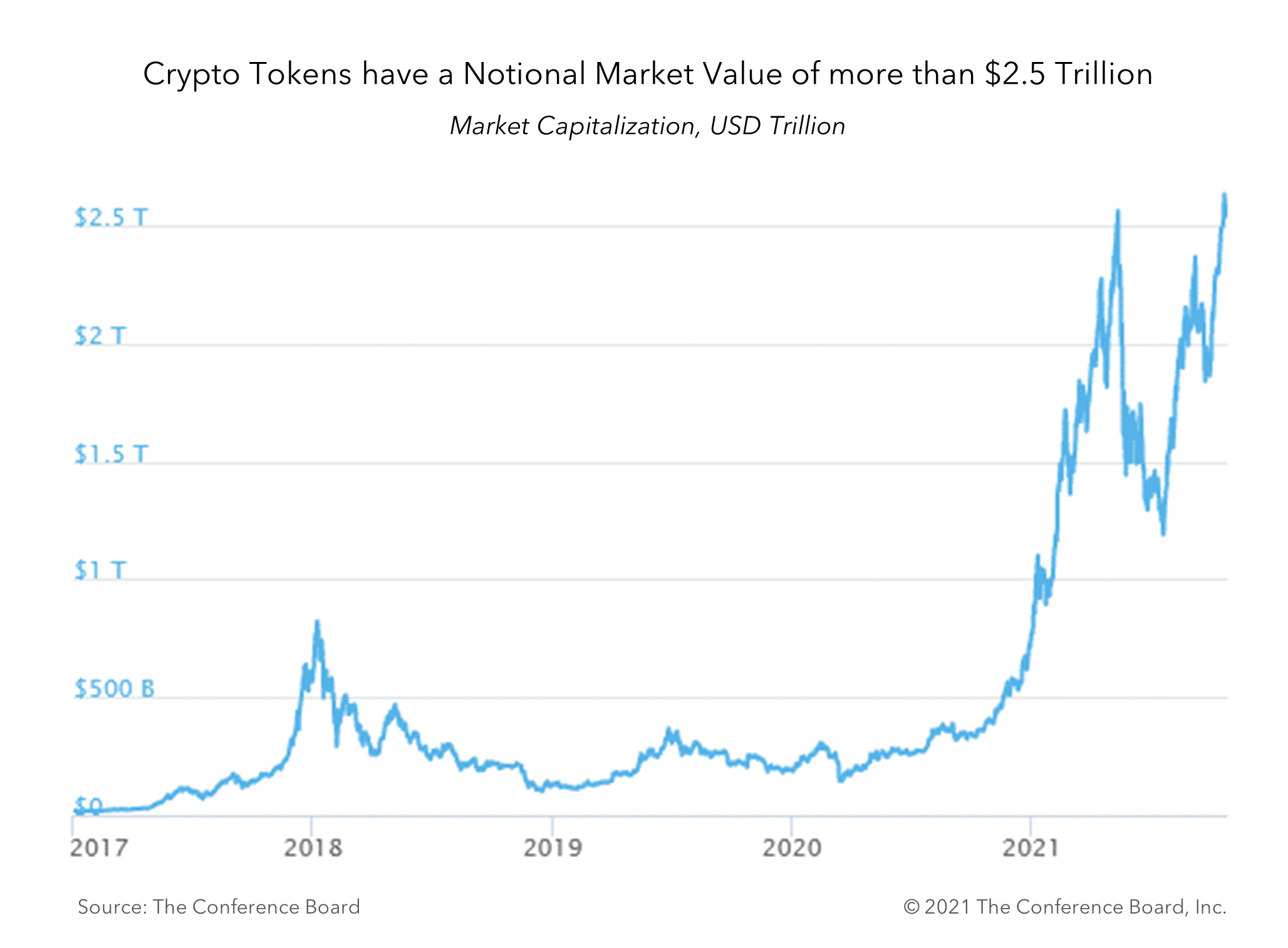

Crypto tokens —often referred to as cryptocurrencies by

originators —have a notional market value of more than $2.5

trillion today and are on pace to expand exponentially. But what are they?

Where did they come from? What is the technology that supports them? Is it a

fad, or like the internet, is it here to stay? How do governments and central

banks view these technologies? How might businesses use the technology and/or

the assets? What are the risks and benefits of adopting them? · What is the history of crypto tokens (i.e.,

cryptocurrencies)? · What are distributed ledger technologies, and

blockchain, their most well-known variation? · What are crypto assets? What types are there? · What are crypto tokens (cryptocurrencies)? · Are crypto tokens actually currencies/money? · Who issues crypto assets and who uses them? · How are businesses using DLT and digital

assets? · What are the challenges/risks to the broad

adoption of crypto assets? · What should businesses think about before

adoption? To help business leaders answer these key questions The

Conference Board recently released a new report, Crypto Assets and

Blockchain: Fad, Threat, or New Normal? Please visit our website for more details. |

|

Stay Informed

The Conference Board COVID-19 Hub. The Conference

Board is uniquely positioned to provide the C-Suite with a 360° view of

implications for business and insights on what’s ahead related to the

COVID-19 Coronavirus. Visit this page often as new resources are being added

to help you effectively and confidently navigate this quickly evolving

situation. |

|

|

|

No comments:

Post a Comment