Workers Covered By Smaller Firms Pay

More Toward Family Premiums and in Cost Sharing Than Those in Larger Ones

Menlo

Park, Calif. – Annual family premiums for

employer-sponsored health insurance rose an average of 3 percent to $18,764

this year, continuing a six-year run of relatively modest increases, according

to the benchmark Kaiser Family Foundation/Health Research & Educational

Trust (HRET) 2017 Employer Health Benefits Survey released today.

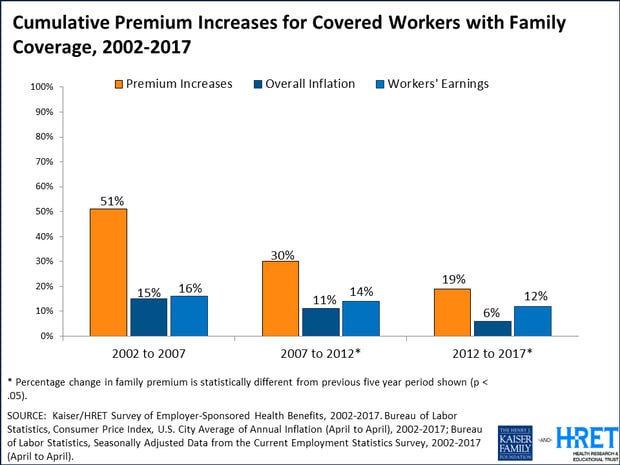

This year’s premium increase

is similar to the rise in workers’ wages (2.3%) and inflation (2%) over the

same period and continues a remarkable slowdown. Since 2012, average

family premiums have increased 19 percent, more slowly than the previous five

years (30% increase from 2007 to 2012) and the five years before that (51% from

2002 to 2007).

At the same time,

workers’ average contribution to family premiums has increased more rapidly

than the employer’s share since 2012 (32% v. 14%). Workers on average now

contribute $5,714 annually toward their family premiums, and those at firms

with fewer than 200 workers contribute more – $6,814 on average.

“Our survey finds employer premiums rose just 3

percent this year - far less than the 20 percent average in the Affordable Care

Act marketplaces,” KFF President and CEO Drew Altman said. “While the marketplaces

seem to get all the attention, the much larger employer market where more than

150 million people get their coverage is very stable.”

“This year’s findings

continue a positive run of a slowing in premium increases and in the growth of

health care costs overall,” said Dr. Jay Bhatt, president of HRET and senior

vice president and chief medical officer at the American Hospital Association.

“As policymakers and providers continue to work to improve health care,

ensuring it remains affordable and accessible is critically important. Wellness

programs continue to be a popular way for employers to offer resources and

financial incentives to their employees to help improve their overall health.”

About 151 million

Americans rely on employer-sponsored coverage, and the 19th annual Kaiser/HRET

survey of more than 2,100 small and large employers provides a detailed picture

of the trends affecting it. In addition to the full report and summary of findings

released today, the journal Health Affairs is publishing a Web First article with select findings, and the Foundation is releasing an

updated interactive graphic that charts the survey's premium trends by firm size,

industry, and other factors.

The survey highlights

big differences in what covered workers at large and small firms pay for their

health care. While there are far more small employers (3.1 million with 3 to

199 workers) than large ones (53,400 with at least 200 workers), more covered

workers are at large firms (71%) than small ones (29%).

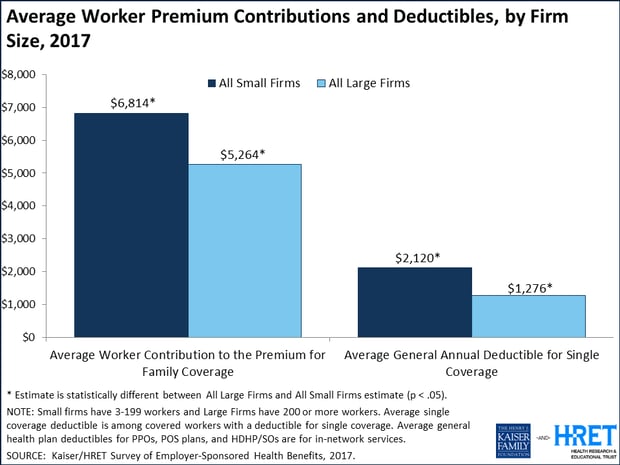

Those covered by small firms generally must pay more

to cover their families:

- Workers covered by small firms on average contribute

$1,550 more annually for family health coverage than those at large firms

($6,814 compared to $5,264).

- The gap occurs in part because small firms are three

times as likely as large ones (45% v. 15%) to contribute the same dollar

amount toward a worker’s health benefits whether or not they enroll family

members. More than a third (36%) of workers at small firms pay most of the

total premiums for family coverage; far fewer (8%) do so at large firms.

- Aggregate family deductibles are also higher at small

firms than at large ones across all types of plans. For example, workers

covered in PPOs (the most common plan type) face an average aggregate

family deductible of $3,660 at small firms, nearly twice the $1,899

average at large ones.

The data are more mixed

for workers enrolled in single coverage:

- Workers on average contribute $1,213 annually toward

their single premium, though workers at small firms on average contribute

less ($1,030) than those at large firms ($1,289).

- The average annual deductible for single coverage

across all workers who face one is $1,505 in 2017, but it is 66 percent

higher for workers at small firms ($2,120) than large firms ($1,276).

The survey finds just

half (50%) of firms with fewer than 50 workers offer health benefits this year,

down significantly from 2012 when 59 percent of firms this size offered

benefits. Among small firms that do not offer health benefits, most say the

most important reason is either high costs (44%) or because they are too small

(17%).

Of these small

non-offering firms, 16 percent say that they provide funds to their employees

to purchase health insurance on their own in the individual market or through

the ACA marketplaces. However, very few (2%) say that the most important reason

is that their employees can get a better deal in the marketplaces.

“Small firms are much

less likely to offer health benefits to their workers, and when they do,

workers may find it quite costly to enroll their families,” said study lead

author Gary Claxton, a KFF vice president and director of the Health Care

Marketplace Project.

Other survey findings include:

- Supplemental benefits. Most large firms that offer health benefits also offer

dental (97%) and vision benefits (82%) separate from any coverage in the health

plans they offer. Fewer offer long-term care insurance (25%). Small firms

that offer health benefits are less likely than large ones to offer any of

these other benefits.

- Financial incentives for wellness. Most large employers offer wellness and/or health

screening programs such as health risk assessments, which are

questionnaires about enrollees’ medical history, health status, and

lifestyle, or biometric screenings, which are health examinations

conducted by a medical professional. Close to half (45%) of large

offering firms provide incentives for workers to participate in these

programs. Among this group, 42 percent offer maximum financial incentives

of at least $500.

- Penalties for tobacco use. Among firms offering health benefits, 16 percent of small

firms and 14 percent of large firms require higher premium contributions

or cost sharing from workers who use tobacco.

- Financial incentives for wellness. Most large employers offer wellness and/or health

screening programs such as health risk assessments, which are

questionnaires about enrollees’ medical history, health status, and

lifestyle, or biometric screenings, which are health examinations

conducted by a medical professional. Close to half (45%) of large

offering firms provide incentives for workers to participate in these

programs. Among this group, 42 percent offer maximum financial incentives

of at least $500.

·

Penalties for tobacco use. Among firms offering health benefits,

16 percent of small firms and 14 percent of large firms require higher premium

contributions or cost sharing from workers who use tobacco.

Methodology

The annual survey is a

joint project of the Kaiser Family Foundation and the Health Research & Educational

Trust. The survey was conducted between January and June of 2017 and included

3,938 randomly selected, non-federal public and private firms with three or

more employees (including 2,137 that responded to the full survey and 1,801

others that responded to a single question about offering coverage). A research

team at Kaiser, HRET, and NORC at the University of Chicago, led by Kaiser vice

president and long-time project director Gary Claxton, designed, conducted, and

analyzed the survey. For more information on the survey methodology, please

visit the Survey Design and Methods Section.

Filling

the need for trusted information on national health issues, the Kaiser Family Foundation is a

nonprofit organization based in Menlo Park, California.

Founded

in 1944, the Health

Research & Educational Trust (HRET) is the not-for-profit research and

education affiliate of the American Hospital Association (AHA). HRET’s mission

is to transform health care through research and education. HRET’s applied

research seeks to create new knowledge, tools and assistance in improving the

delivery of health care by providers and practitioners within the communities

they serve. For more information about HRET, visit http://www.hret.org.

Health

Affairs is the

leading peer-reviewed journal at the intersection of health, health care, and

policy. Published monthly by Project HOPE, the journal is available in print,

online, and on mobile and iPad app. Additional and late-breaking content is

found at www.healthaffairs.org

No comments:

Post a Comment