|

|

To be a Medicare Agent's source of information on topics affecting the agent and their business, and most importantly, their clientele, is the intention of this site. Sourced from various means rooted in the health insurance industry - insurance carriers, governmental agencies, and industry news agencies, this is aimed as a resource of varying viewpoints to spark critical thought and discussion. We welcome your contributions.

Tuesday, March 29, 2022

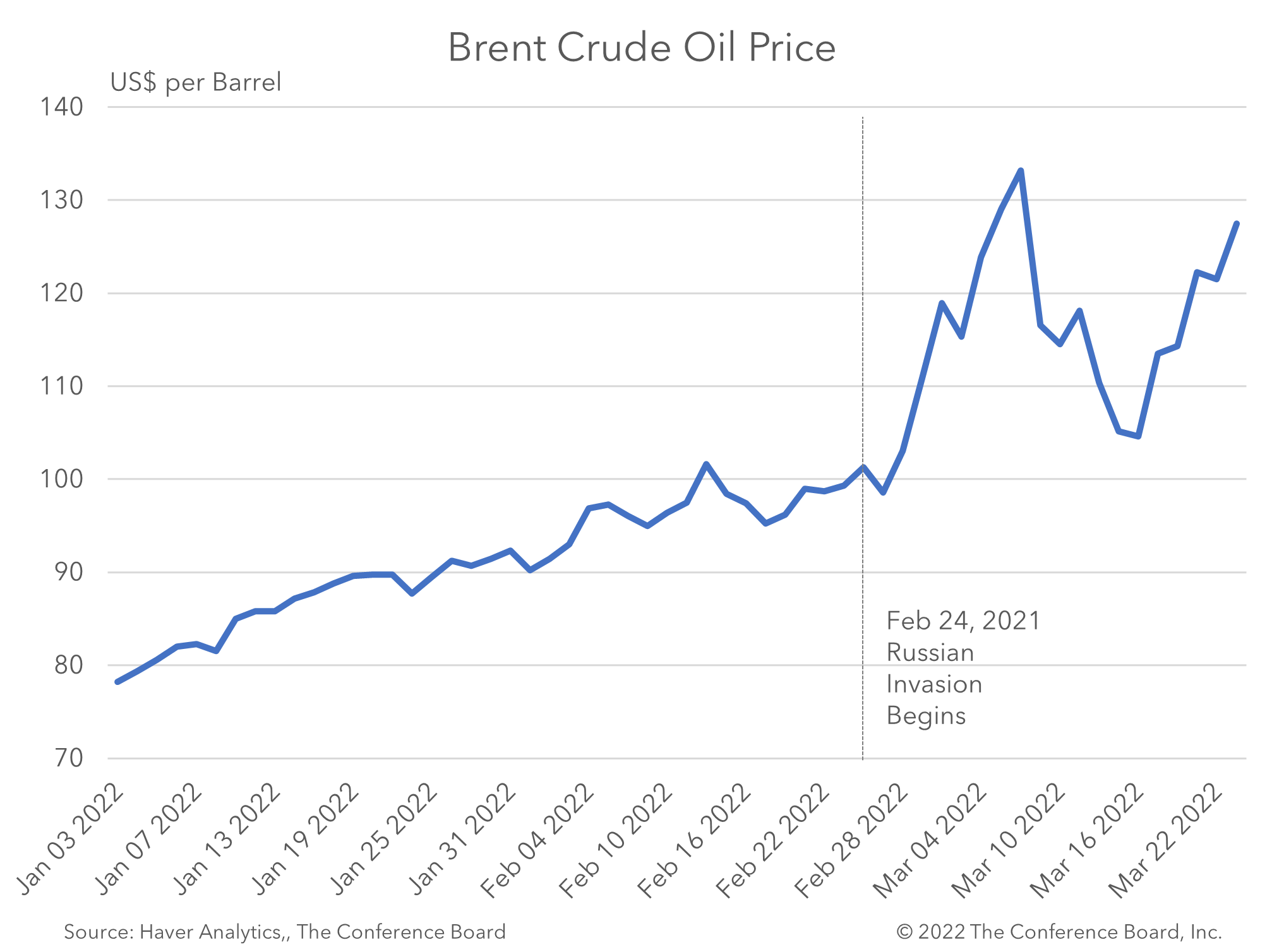

What if Oil Hits US$200 per Barrel?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment