|

Just Released

|

|

|

As Senate Weighs Bipartisan Stabilization Bill with Cost-Sharing

Reduction Funding, Current Marketplace Enrollees Face Challenges with

Affordability

Knowledge and Awareness of Key

Facts Regarding Enrollment Is Low

As the Nov. 1 start of the Affordable Care Act’s open

enrollment period nears, new polling data

from the Kaiser Family Foundation

finds that most potential enrollees are unaware of when they can enroll and

have not seen any related advertisements.

Fielded

prior to yesterday’s announcement of a bipartisan marketplace stabilization

deal in the Senate that among other things would increase outreach funding,

the survey highlights key gaps in knowledge among people who are uninsured or

who are current marketplace enrollees.

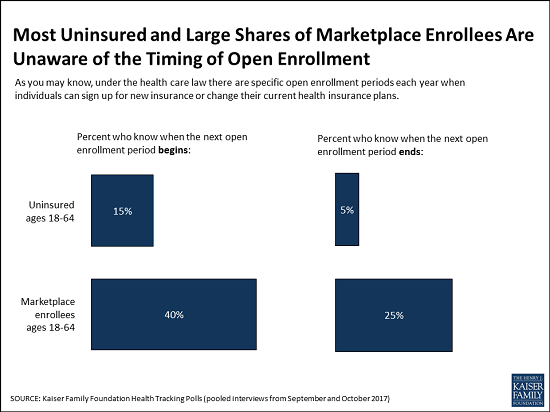

One

in six (15%) people without health insurance and four in 10 (40%) marketplace

enrollees know that open enrollment begins on Nov. 1 this year. Even fewer

(5% of the uninsured, 25% of marketplace enrollees) are aware of the month

when open enrollment ends in their state.

The poll finds that few of those most likely to

consider marketplace coverage report hearing or seeing any ads providing

information about how to get insurance under the health care law. Small

shares of the uninsured (19%) and marketplace enrollees (12%) say they saw

ads in the past 30 days that provided information about how to get insurance.

Slightly

more than half (54%) of the uninsured say they plan to get health insurance

in the next few months, while four in 10 (43%) expect to remain uninsured

despite the individual mandate.

Most

marketplace enrollees satisfied with their plans but worry about costs

While

Congress weighs legislative changes to stabilize the marketplaces, the new

survey also provides a snapshot of the experiences of current marketplace

enrollees. Despite reports of plans dropping out of the marketplaces, most

(70%) report being satisfied with their insurance choices. However, nearly

four in 10 (36%) say they are worried that their current insurance company

will stop selling plans in their area.

At

a time when funding for cost-sharing reduction payments hangs in the balance

in Congress, significant shares of marketplace enrollees report struggling

with and worrying about affordability issues. For example:

Marketplace

enrollees’ concerns about cost and availability in many ways are similar to

those of people with employer coverage. For example, about half (49%) of

those with employer coverage report that their deductibles and co-pays have

been going up lately. Similarly, half (51%) say their premiums have been

going up, including a quarter (25%) who say they have gone up a lot.

The

poll also finds most of the public (71%), including most marketplace

enrollees (79%), are aware that the Affordable Care Act’s individual mandate

that requires most people to obtain health coverage or pay a fine remains in

effect. Among the uninsured, a smaller majority (59%) are aware the mandate

is in effect, though one in five (18%) believe it is not and one in four

(23%) are unsure.

The

vast majority (85%) of marketplace enrollees also say they plan to sign up

for health insurance during the 2018 open enrollment period, and most of them

(54% of the total marketplace enrolllees) prefer to renew their current plan

if it is available next year.

Among

marketplace enrollees, one in four (26%) say the law’s requirement for them

to have health insurance or else pay a fine is a “major reason” they chose to

purchase coverage. However, most (55%) say it was “not a reason,” and the

vast majority (90%) say they would continue to buy their own insurance even

if the government stopped enforcing this requirement.

METHODOLOGY

Designed

and analyzed by public opinion researchers at the Kaiser Family Foundation,

the poll was conducted by telephone from Sept. 13 - 24 and Oct. 5 - 10, 2017

among a random sample of 2,505 adult U.S. residents, including an oversample

of respondents who purchase their own insurance (non-group enrollees).

Interviews were conducted in English and Spanish by landline (867) and cell

phone (1,638). The margin of sampling error is plus or minus 2 percentage

points for the full sample, plus or minus 9 percentage points for marketplace

enrollees (n=195), plus or minus 7 percentage points for the uninsured ages

18-64 (n=206), and plus or minus 4 percentage points for those ages 18-64

with employer coverage (n=935). For results based on other subgroups, the

margin of sampling error may be higher.

Filling

the need for trusted information on national health issues, the

Kaiser Family Foundation is a nonprofit organization based in Menlo Park,

California.

|

|

To be a Medicare Agent's source of information on topics affecting the agent and their business, and most importantly, their clientele, is the intention of this site. Sourced from various means rooted in the health insurance industry - insurance carriers, governmental agencies, and industry news agencies, this is aimed as a resource of varying viewpoints to spark critical thought and discussion. We welcome your contributions.

Wednesday, October 18, 2017

As Senate Weighs Bipartisan Stabilization Bill with Cost-Sharing Reduction Funding, Current Marketplace Enrollees Face Challenges with Affordability

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment