|

Just Released

|

|

Poll: Ahead of House Tax Reform Vote, Americans are More Likely to

Rank Children’s Health Care, Hurricane Relief and Other Issues as Top

Priorities for Washington

Controlling

Immigration Tops Republicans’ Priority List, With Tax Reform among a Number

of Second-Tier Issues Including Hurricane Relief and ACA Repeal

Most of the Public Initially

Favors Getting Rid of the ACA’s Individual Mandate As Part of Tax Reform, But

Some Become Opponents When Presented with Facts and Arguments for Keeping the

Mandate

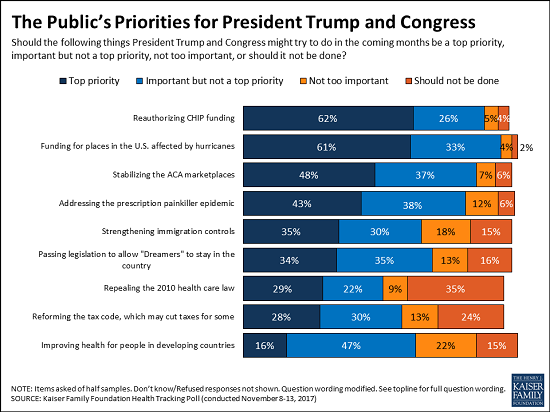

As the House prepares to vote Thursday on its tax

reform bill, a new Kaiser Family Foundation poll finds almost three

in 10 Americans (28%) view tax reform as a top priority for President Trump

and Congress.

That’s significantly fewer than the share that say

the same about reauthorizing funding for the Children’s Health Insurance

Program (62%), hurricane recovery funding (61%), stabilizing the Affordable

Care Act’s insurance marketplaces (48%) and addressing the prescription

painkiller epidemic (43%). Two immigration-related issues -

strengthening controls to limit who enters the country (35%) and passing

legislation to allow the Dreamers to legally stay (34%) – also rank higher,

while a similar share (29%) say repealing the Affordable Care Act is a top

priority.

Among Republicans, half (51%) say reforming the

tax code is a top Washington priority, behind strengthening immigration

controls (69%) but similar to the share who consider hurricane recovery

funding (52%), repealing the Affordable Care Act (50%), stabilizing the

insurance marketplaces (46%) and reauthorizing CHIP funding (46%) to be top

priorities.

In a tweet Monday, President Trump called on

Congress to end the Affordable Care Act’s individual mandate, which requires

most Americans to have health insurance or pay a tax penalty and has long

been the least popular provision in the law. While the House tax reform bill

does not currently address the mandate, key Republican senators said Tuesday

that they will include such a provision in their version of the bill.

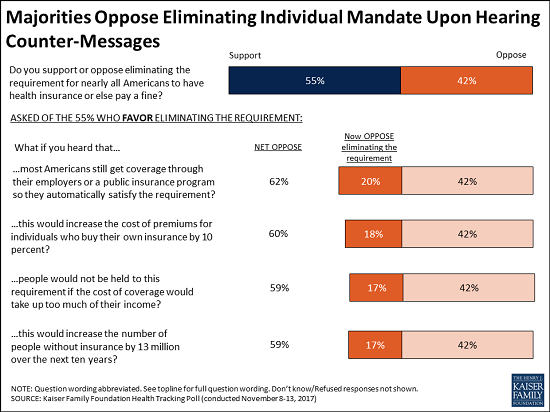

The new poll finds that most Americans (55%)

initially support eliminating the mandate as part of tax reform, while four

in 10 (42%) oppose it. Most Republicans (73%) and independents (58%) support

ending the mandate, while most Democrats (59%) oppose it.

These views are malleable, with about a third of

supporters (representing a fifth of the public overall) switching to oppose

the mandate’s repeal when presented with facts and arguments about who is

impacted and potential consequences of its repeal.

For example, the share who oppose eliminating the

mandate can rise as high as 62 percent when initial supporters hear that most

Americans get coverage through their employers or government programs that

meets the mandate’s requirements. Similar majorities ultimately oppose

eliminating the mandate when presented with other arguments against it,

including that premiums for people who buy their own health insurance would

go up, that people are exempted from the mandate if the cost of coverage

takes up too much of their income and that getting rid of the mandate would

result in 13 million more people being uninsured over the next 10 years, as

the Congressional Budget Office has estimated.

One provision in the House bill would eliminate a

tax deduction that allows people with high medical costs to deduct any

medical and dental expenses that exceed 10 percent of their income. A

majority (68%) of the public – including majorities of Democrats (77%),

independents (66%), and Republicans (61%) oppose eliminating the tax

deduction for individuals who have high health care costs.

More than four in 10 (44%) of the public think

eliminating the deduction for high medical costs will affect them and their

families, though in reality a much smaller share of the public uses that

deduction in any given tax year. According to the Internal Revenue Service,

about 17 percent of taxpayers who file itemized deductions use this deduction

(approximately 6% of all taxpayers and 3% of the public).

Looking ahead to the 2018 midterm elections, the

public is divided over whether not passing a tax reform plan or not repealing

the ACA would be a bigger deal for President Trump and Republicans. Nearly

half of the public say it will be a bigger problem if the president and

Republicans are unable to pass their tax reform plan (47%), similar to the

share who say it will be a bigger problem if they are unable to revive a

repeal of the ACA (44%). Republicans are also divided, with similar shares

saying it would be a bigger deal if President Trump and

Republicans are unable to repeal the ACA (50%) and if they are unable to pass

tax reform (45%).

Designed and analyzed by public opinion

researchers at the Kaiser Family Foundation, the poll was conducted from

November 8 – 13, 2017 among a nationally representative random digit dial

telephone sample of 1,201 adults. Interviews were conducted in English and

Spanish by landline (415) and cell phone (786). The margin of sampling error

is plus or minus 3 percentage points for the full sample. For results based

on subgroups, the margin of sampling error may be higher.

Filling

the need for trusted information on national health issues, the

Kaiser Family Foundation is a nonprofit organization based in Menlo Park,

California.

|

To be a Medicare Agent's source of information on topics affecting the agent and their business, and most importantly, their clientele, is the intention of this site. Sourced from various means rooted in the health insurance industry - insurance carriers, governmental agencies, and industry news agencies, this is aimed as a resource of varying viewpoints to spark critical thought and discussion. We welcome your contributions.

Monday, November 20, 2017

Ahead of House Tax Reform Vote, Americans are More Likely to Rank Children’s Health Care, Hurricane Relief and Other Issues as Top Priorities for Washington

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment