|

Just Released

|

||

|

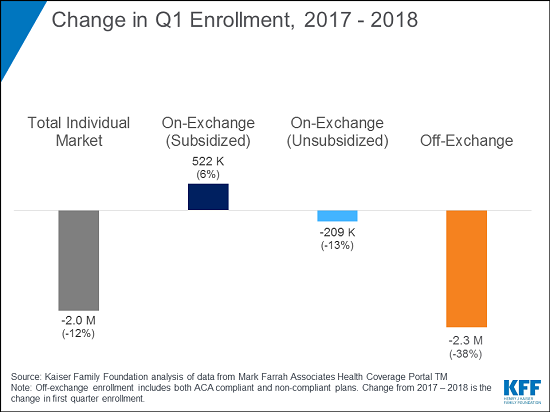

Enrollment in the Individual Insurance Market Continued to Fall

in the First Quarter of 2018, With the 12 Percent Overall Decline Concentrated

in Off-Exchange Plans

Enrollment in the

individual insurance market continued to shrink in the first quarter of 2018,

declining by 12 percent compared to the first quarter of 2017, according to a new analysis from the Kaiser Family Foundation. The

decline was concentrated in off-exchange plans where enrollees are not

eligible for Affordable Care Act subsidies and have had to pay the full cost

of recent premium increases.

At the same time, enrollment in plans sold through

the ACA exchanges (also known as Marketplaces) has largely remained stable,

increasing by 3 percent in 2018 after declining somewhat from a peak of 11.1

million people in 2016, the analysis finds. In the first quarter of

2018, 10.6 million people had coverage through the ACA exchanges, including

9.2 million receiving federal premium subsidies. (A modest gain in enrollment

among subsidized exchange enrollees was partially offset by a decline among

those not eligible for federal help with their premiums.)

The departure of about two million people from the

individual market overall in Q1 2018 follows a decrease in total

enrollment in 2017. In both years, the steepest declines have been in

off-exchange enrollment, which tumbled 38 percent in the first quarter of

2018 relative to the same period in 2017, the analysis finds.

As unsubsidized consumers drop plans or seek

coverage elsewhere, people with low incomes who are eligible for ACA premium

subsidies and those with pre-existing conditions make up an increasingly

larger share of the individual market. Nearly two-thirds of enrollees in the

total individual market were subsidized in the first quarter of 2018, the

analysis shows. The trend is likely to continue in 2019 with the repeal of

the individual mandate penalty and the expected expansion of short-term

health plans, both of which would likely siphon away healthy people and push

up premiums further.

The individual market comprises coverage purchased

by individuals and families. As measured by insurance regulators, the market

is in many ways a mixture of very different types of coverage: subsidized

policies purchased through the ACA exchanges, ACA-compliant policies

purchased on and off the exchanges and non-compliant short-term insurance

plans and grandfathered non-compliant policies that were purchased before the

ACA went into effect.

Despite the recent decline in overall individual

market enrollment, there are still 14.4 million people enrolled as of the

first quarter of 2018, compared to 10.6 million people in 2013, the year

before the ACA subsidies and market rules protecting people with pre-existing

conditions took effect. The biggest decline in individual market enrollment

from 2015 to 2017 has been in non-ACA-compliant coverage.

Filling

the need for trusted information on national health issues, the Kaiser Family Foundation is a nonprofit

organization based in San Francisco, California.

|

||

|

||

To be a Medicare Agent's source of information on topics affecting the agent and their business, and most importantly, their clientele, is the intention of this site. Sourced from various means rooted in the health insurance industry - insurance carriers, governmental agencies, and industry news agencies, this is aimed as a resource of varying viewpoints to spark critical thought and discussion. We welcome your contributions.

Tuesday, July 31, 2018

Enrollment in the Individual Insurance Market Continued to Fall in the First Quarter of 2018

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment