|

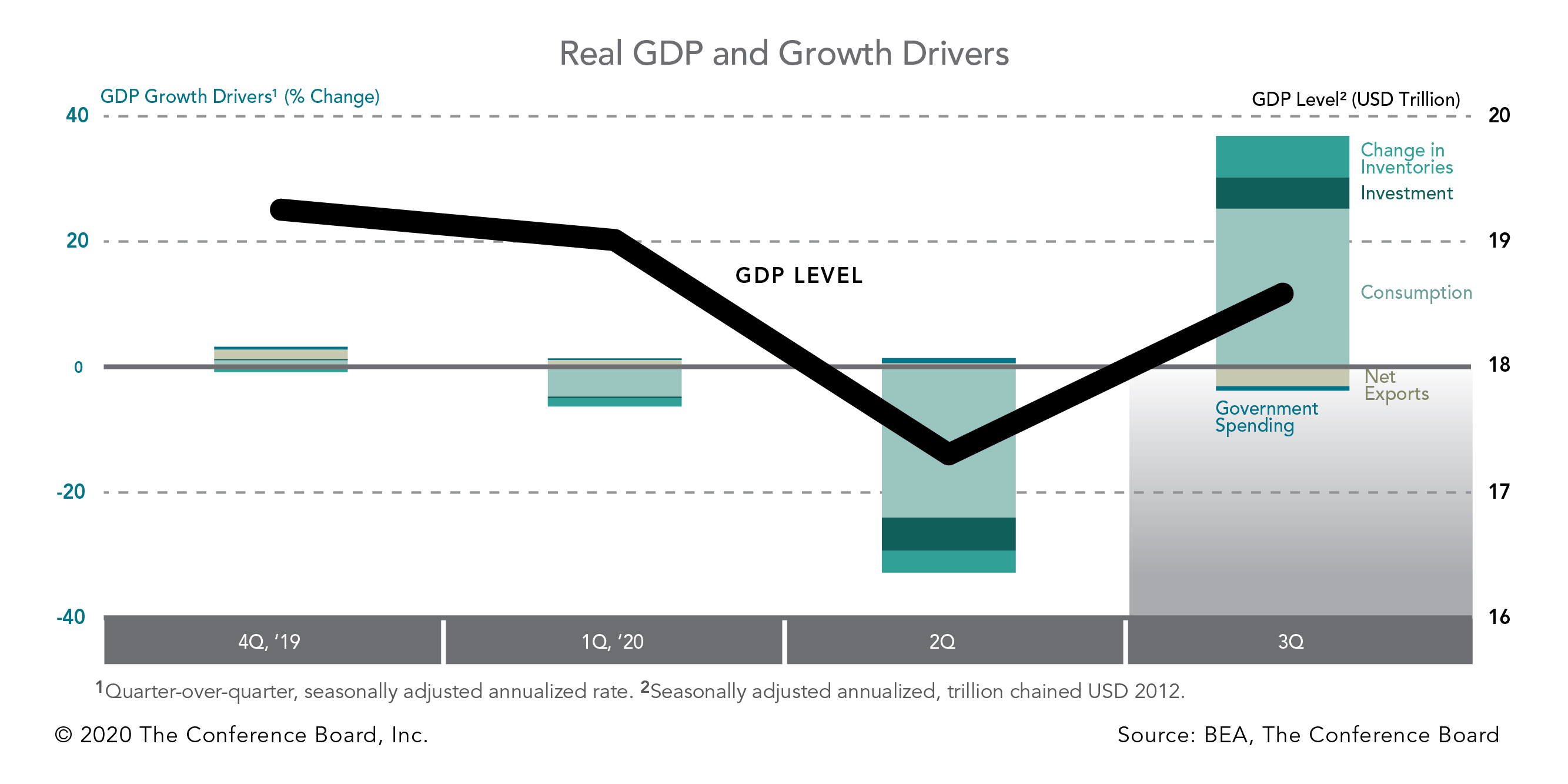

US real gross domestic product (GDP)

expanded by 33.1 percent (annualized) during the third quarter of 2020,

following a 31.4 percent contraction in Q2. While this was the largest

quarterly growth rate on record, the US economy remains 3.5 percent smaller

than it was prior to the pandemic in Q4 2019.

Third quarter GDP growth was driven primarily by a large rebound in

consumption and stronger inventories and investment. While consumption was

the largest contributor to overall growth this quarter, it remains

approximately $436 bln below its Q4 2019 level (about 3.3 percent lower).

Although spending on goods (many of which are imported) exceeded prepandemic

levels, the strength was more than offset by a deterioration in spending on

services, which are mostly produced domestically. Inventories, which fell

sharply in the second quarter, improved in Q3 and contributed seven

percentage points to overall GDP growth. Investment activities also helped Q3

growth. Residential investment exceeded Q4 2019 levels by $31.3 bln, but

nonresidential investment was still down $136.7 bln. Meanwhile, government

spending and net exports were a drag on growth in Q3. Government spending

fell $38.3 bln, pulling overall GDP growth down by 0.68 percent. An uneven

rebound in export and import growth yielded an annualized trade deficit of

over $1 tln—the largest on record.

Looking ahead, given the resurgence in new COVID-19 cases, the limited

recovery in the labor market, and uncertainty over passage of another fiscal

stimulus package, it is unlikely that economic activity will significantly

improve in Q4 2020. We anticipate incremental growth in the months ahead but

do not expect the US economy to return to a prepandemic level of output until

the second half of 2021.

|

No comments:

Post a Comment