|

Click on the chart to enlarge

|

|

|

|

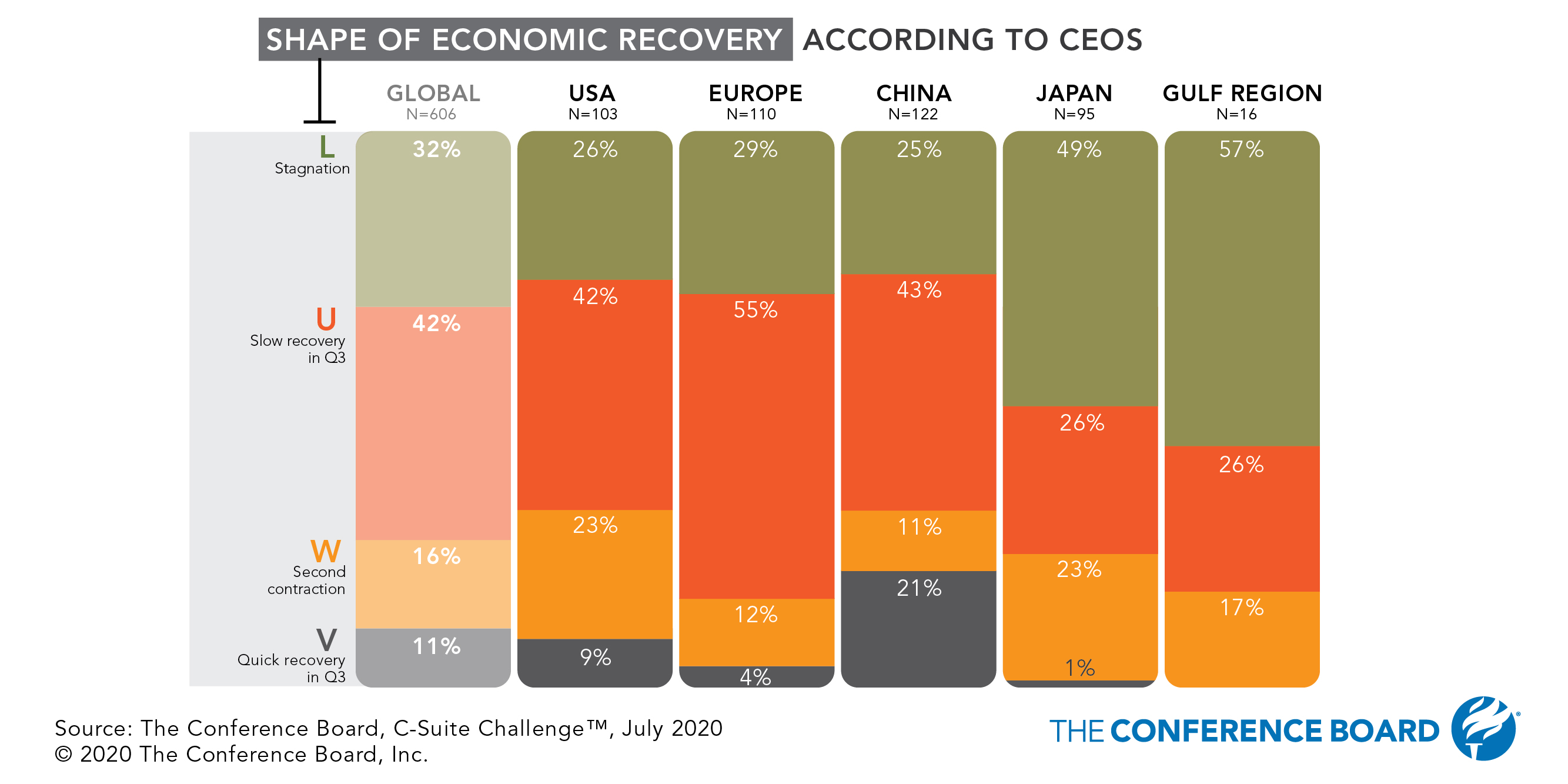

Early hopes of a rapid, V-shaped recovery—a deep drop but

swift pickup of growth in Q3—have been dashed world-wide. Most CEOs around

the globe believe the economic recovery will be slow, and it could take

considerable time before output recovers to prepandemic levels. In China,

Europe, and the US, between 42 and 55 percent of CEOs envision a U-shaped

pattern: partial shutdown measures control localized outbreaks with countries

gradually succeeding in managing the pandemic. Growth would be sluggish and

wouldn’t reach prepandemic levels until the final quarter of 2020. Other

CEOs, especially those in Japan and the US, envision a W-shaped scenario: the

continued risk of new outbreaks and a second resurgence of the virus lead to

more stringent containment measures and a new contraction of output during

the second half of the year. Output would see another drop in the second half

of 2020, and any further recovery will be put off until well into 2021.

A smaller but significant number of CEOs in China, Europe, and the US envision an L-shaped recovery: growth would not resume until 2021. A near majority of CEOs in Japan and more than half in the Gulf Region share this pessimistic view. For business leaders in the Gulf region, the challenges of volatile oil prices and the long-term viability of petroleum-based growth models play an important role. China is an exception—the economy there already took its biggest hit during the initial virus outbreak in February and March. Some strong recovery already took place in the second quarter, and nearly one quarter of CEOs in China presume a continuation of this V-shaped growth recovery. Nevertheless, 43 percent of CEO in China share the more pessimistic view of their global peers that recovery will be more gradual and U-shaped. |

No comments:

Post a Comment